How Much Does It Cost To Register Your Business With The Irs

How Much Does It Price to Start an LLC?

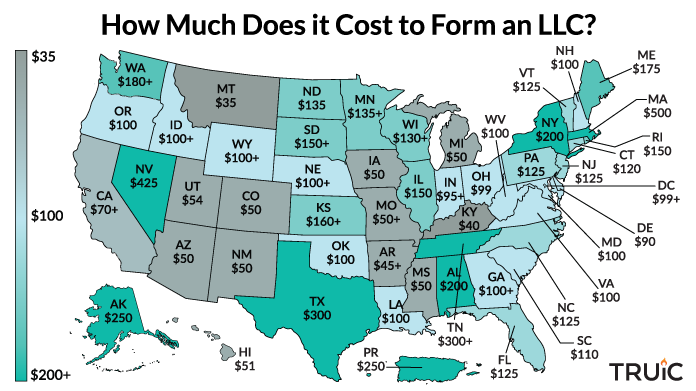

The primary cost of forming a limited liability visitor (LLC) is the state filing fee. This fee ranges betwixt $twoscore and $500, depending on your state.

At that place are ii options for forming your LLC:

- Yous tin can rent a professional LLC formation service to prepare your LLC (for an boosted minor fee).

- Or, y'all can use our free Course an LLC guide to practice it yourself.

Have a professional service course an LLC for you.

Two such reliable services:

- Cost to Form an LLC

- Ongoing LLC Maintenance Costs

- Toll to Form an LLC in Every State

- How to Annals an LLC Yourself

- Hiring an LLC Service Provider

Price to Form an LLC

The main cost of forming an LLC is the fee to file your LLC'south articles of organisation with the Secretary of State. This fee ranges from $xl-$500, depending on the state.

Other LLCs costs might include:

- Business licensing and permit fees

- Publication fees in Arizona, Nebraska, and New York

- Optional LLC name reservation fees (required in Alabama)

- Optional fictitious name fee (also known as DBA name)

Looking to salve money? Visit our How to Save Money Forming Your LLC page.

State Filing Fee

The fee to register an LLC with the Secretary of State ranges betwixt $40 and $500, depending on your state.

Yous can grade an LLC yourself with our free Grade an LLC guides and pay only the country registration fee:

- Alabama LLC

- Alaska LLC

- Arizona LLC

- Arkansas LLC

- California LLC

- Colorado LLC

- Connecticut LLC

- Delaware LLC

- Florida LLC

- Georgia LLC

- Hawaii LLC

- Idaho LLC

- Illinois LLC

- Indiana LLC

- Iowa LLC

- Kansas LLC

- Kentucky LLC

- Louisiana LLC

- Maine LLC

- Maryland LLC

- Massachusetts LLC

- Michigan LLC

- Minnesota LLC

- Mississippi LLC

- Missouri LLC

- Montana LLC

- Nebraska LLC

- Nevada LLC

- New Hampshire LLC

- New Bailiwick of jersey LLC

- New Mexico LLC

- New York LLC

- North Carolina LLC

- N Dakota LLC

- Ohio LLC

- Oklahoma LLC

- Oregon LLC

- Pennsylvania LLC

- Rhode Island LLC

- Due south Carolina LLC

- South Dakota LLC

- Tennessee LLC

- Texas LLC

- Utah LLC

- Vermont LLC

- Virginia LLC

- Washington LLC

- Washington D.C. LLC

- West Virginia LLC

- Wisconsin LLC

- Wyoming LLC

Other LLC Costs and Fees

Business Licenses and Permits

Depending on your industry and geographical location, your business might need federal, state, and local permits/licenses to legally operate. This is true whether you form an LLC or any other type of business structure.

Recommended: Visit our land-past-state How to Get a Business License guide.

Publication Fees

Some states (Arizona, Nebraska, and New York) require your new LLCs to publish a statement of germination in a local newspaper.

Publishing costs tin exist between $40 and $2000, depending on your land's requirements.

Name Reservation Fee

If you're forming an LLC in Alabama, you lot will also need to reserve your LLC's name for a fee of $10-$28. Reserving a name is optional for all other States.

Fictitious Name Fee

A fictitious name isn't required for LLCs. Later on yous form your LLC, you lot might want to create a fictitious name to create divide brands nether your main LLC. A fictitious name is usually referred to every bit a DBA or "doing business as" proper noun.

Where Should I Form My LLC?

You should always form your LLC in the country where yous programme to conduct business. Otherwise, you lot may end up with additional unwanted costs and paperwork.

To learn more, visit our Best State to Form an LLC guide.

Recommended: Learn more most LLC germination services in our best LLC services review.

Cost to Form an LLC in Every Country

The table below provides the filing fees in each state equally well as any annual expenses.

Recommended: Select the state name for a more detailed report.

Ongoing Maintenance Costs

In some states, LLCs will be required to pay ongoing maintenance costs and taxes such as:

- Franchise Tax

- Annual Report Fees

Franchise Revenue enhancement

Some states levy a yearly revenue enhancement on LLC's (often chosen a franchise tax). This is usually a flat tax, but tin can also vary according to your LLC'southward annual earnings in certain states.

Almanac/Biennial Report

Virtually states require LLCs to submit an annual or biennial study which includes updating the name, address, and ownership of the LLC. The written report fee varies state by land.

Visit our state-specific LLC Annual Report guides to learn more near almanac fees and franchise revenue enhancement.

How to Register an LLC Yourself

Forming an LLC yourself is easy. Our country-by-state LLC formation guides simplify the procedure into five basic steps.

Recommended: If you already have a business organisation that is running every bit a sole proprietorship, visit our How to Change from a Sole Proprietorship to LLC folio.

Five Basic Steps to Kickoff an LLC

Footstep 1: Proper noun Your LLC

Step 2: Choose a Registered Agent

Step 3: File the Articles of Organization

Step 4: Create an Operating Agreement

Pace 5: Get an EIN

Step 1: Proper name Your LLC

When you proper name your LLC, yous'll demand to choose a proper name that:

- Is available for use in your state

- Meets your state's naming requirements

- Is available as a web domain

Recommended: Visit our Form an LLC guide for detailed naming rules and instructions for registering a business concern name in your state.

Not certain what to name your business? Bank check out our How to Name a Business concern guide and costless LLC Name Generator.

Step 2: Cull a Registered Agent

LLCs must appoint a registered amanuensis in most states. A registered agent primarily acts as your LLC's main betoken of contact with the state. But most importantly, they are responsible for accepting service of process in the outcome your business is sued.

A registered agent must:

- Be at least 18 years or older

- Take a concrete address in the LLCs country

- Available during normal business organization hours to accept service of process

TIP: Many LLC formation services include a gratuitous year of registered agent service when y'all class your LLC. ZenBusiness charges $39 (plus state fees) for LLC formation and includes a costless twelvemonth of registered agent services.

Step 3: File the Articles of Organization

The articles of organization, as well known every bit the certificate of formation or certificate of organization, is a document that is filed with your state to form an LLC.

The fee to file the articles of organization varies from $xl-$500, depending on your state.

Step 4: Create an Operating Agreement

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more than information on operating agreements, read our LLC operating agreement guide.

Step 5: Get an EIN

What is an EIN? An EIN or Employer Identification Number is a nine-digit number issued by the Internal Revenue System (IRS) to identify a business for tax reporting purposes. An EIN is essentially a Social Security number (SSN) for the visitor.

Why practise I need an EIN? An EIN number is required for the following:

- To open a business organization banking concern account

- For Federal and State tax purposes

- To rent employees

Free EIN:You tin get an EIN from the IRS (free of charge) after forming your business concern. This tin can be washed online on the IRS website or by mail.

Hiring an LLC Service Provider

Should you hire a professional LLC germination visitor? LLC service providers make the procedure of setting up your business easier, but they aren't required.

Recommended: Visit our Form an LLC guide and find easy instructions for starting an LLC yourself and only pay the state fee.

Basic LLC Germination Service Bundle: $39 - $79

Online services similar ZenBusiness ($39 + Country Fee) and LegalZoom ($79 + Land Fee) will take care of the LLC filing process on your behalf for a fraction of the cost of a concern attorney.

In addition to filing your document of formation, LLC formation providers offer other services. LLC germination services will as well:

- Create your LLC operating agreement

- Register for your LLCs Employee Identification Number (EIN) with the IRS

- Act equally your registered agent, oftentimes for free for the first year

Operating Agreement: $40-$99

An operating agreement is a governing certificate that outlines the ownership and management construction of an LLC.

Purchasing a custom operating agreement from an online formation service is an easy way to ensure you'll have a thorough and legally-binding document governing your new LLC.

EIN Registration: $60-$lxx

After forming your LLC, you'll demand to become an EIN (or Employer Identification Number)—essentially a Social Security number for your concern. If you lot'd prefer not to apply for your EIN directly through the IRS, you can delegate this job to your germination provider for an extra fee.

Registered Agent Service: $0-$125 per yr

You'll need to designate a registered agent for your LLC when you consummate the certificate of formation.

A registered agent is an private or business concern entity responsible for receiving and processing legal documents and service of procedure on behalf of your business.

Many people choose to engage a professional registered amanuensis for privacy, convenience, and discretion.

Learn more than almost hiring a registered agent in our Should I Utilise a Registered Agent Service guide.

If yous decide that hiring a registered agent is correct for your LLC, nosotros recommend ZenBusiness. Their registered agent services are free for the first yr and $119 every post-obit yr.

Business License Enquiry Service: $99

If your LLC requires several federal, state, and local permits or licenses in social club to legally operate, y'all might want to consider hiring a professional person business license research service.

If you're looking to maximize your fourth dimension in the early phases of your business, nosotros recommend checking out Incfile's $99 business organization license enquiry package.

Recommended: Visit our state-past-state How to Become a Business organization License guide.

Thinking nigh using an LLC formation service? Check out our Best LLC Services review.

LLC Toll FAQ

Practice y'all take to pay for an LLC every year?

In some states, there is an annual franchise tax and/or annual written report fee. Visit our LLC annual report guide and choose your state to acquire exactly what ongoing fees might be required in your state.

Is an LLC really necessary?

An LLC provides limited liability protection. This means an LLC protects your personal assets in the consequence of a business loss such as a lawsuit or unpaid debt.

We recommend any minor business concern that carries even the smallest amount of risk or liability, to form an LLC. Learn more than in our Should I Get-go an LLC guide.

What is the cheapest mode to go an LLC?

Y'all tin can salve money on getting an LLC by:

- Completing the formation procedure yourself

- Making your ain operating agreement

- Being your own registered agent, and getting your own EIN.

Check out our How to Save Money Forming Your LLC guide to learn more.

Can I pay myself a salary from my LLC?

You can pay yourself a bacon from your LLC but it would be called a draw or distribution if your LLC is taxed in the default style by the IRS.

Visit our How Do I Pay Myself From My LLC guide to acquire more.

Is an Due south corp better than an LLC?

An Southward corporation (S corp) is an IRS tax status, non a type of business entity. An LLC can be taxed in the default fashion or as an S corp. For some businesses, being taxed equally an South corp can make lots of sense.

Cheque out our Southward Corp vs LLC guide to acquire if S corp condition is right for your business.

Is LegalZoom worth it for an LLC?

LegalZoom creates more than LLCs than any other provider. They also accept mediocre reviews and charge more than any other service provider. Nosotros think in that location are better LLC formation services out in that location.

Check out our Best LLC Services review to acquire more.

What's amend sole proprietorship or LLC?

A sole proprietorship is simply proficient for businesses that behave very low risk of liability considering sole proprietorships don't offering whatever liability protection.

Learn more than in our sole proprietorship vs LLC guide.

What all can you do with an LLC?

There are many advantages to starting an LLC. Visit our guide to learn more than nigh the benefits of an LLC.

Does having an LLC help with taxes?

An LLC can help with taxes if your business needs more options. An LLC can be taxed via pass-through revenue enhancement, as an S corp, or as a C corp.

Visit our Choosing a Business concern Structure guide to learn what blazon of business structure would offering the most taxation benefits to your unique business concern.

Is it meliorate to have an LLC or corporation?

Both corporations and LLCs offer limited liability protection.

LLCs are easier to set and run. LLCs too toll less. Corporations are useful for small businesses and startups that need to rely on outside investors.

Acquire more than in our LLC vs Corporation guide.

How Much Does It Cost To Register Your Business With The Irs,

Source: https://howtostartanllc.com/cost-to-form-an-llc

Posted by: cramptonsmis1975.blogspot.com

0 Response to "How Much Does It Cost To Register Your Business With The Irs"

Post a Comment